The Beginning of My Stock Trading Journey - The Wandering Trader (Ending April 2020 ECQ up by +20.82% in My Portfolio)

DISCLAIMER:

The Wandering Trader is not responsible for any damages or losses related to any products and services mentioned in the content. The Wandering Trader encourages the readers to conduct their own investigations with due diligence on the company, product or service mentioned. This content is for educational purposes only. There is no guarantee that you will earn any money using the techniques and ideas mentioned in this content. This is not financial advice. Your level of success in attaining the results claimed in this video will require hard-work, experience, and knowledge.

AFFILIATE DISCLOSURE: This content and description may contain affiliate links, which means that if you click on one of the product links, I’ll receive a small commission. I won't put anything here that I haven't verified and/or personally used myself.

March 19, 2020 – the day that Philippine Stock Exchange hit the MASSIVE SELL OFF from investors around the world, including my shares from ALI, due to historical pandemic crisis! Making a slashed off at 4,623.42 with -711.95pts (-46% fall) from the previous price level. Leaving no one but devastation seeing their portfolio’s in blood bath.

Stock market is highly volatile. This is NOT for everybody.

The Wandering Trader is not responsible for any damages or losses related to any products and services mentioned in the content. The Wandering Trader encourages the readers to conduct their own investigations with due diligence on the company, product or service mentioned. This content is for educational purposes only. There is no guarantee that you will earn any money using the techniques and ideas mentioned in this content. This is not financial advice. Your level of success in attaining the results claimed in this video will require hard-work, experience, and knowledge.

AFFILIATE DISCLOSURE: This content and description may contain affiliate links, which means that if you click on one of the product links, I’ll receive a small commission. I won't put anything here that I haven't verified and/or personally used myself.

March 19, 2020 – the day that Philippine Stock Exchange hit the MASSIVE SELL OFF from investors around the world, including my shares from ALI, due to historical pandemic crisis! Making a slashed off at 4,623.42 with -711.95pts (-46% fall) from the previous price level. Leaving no one but devastation seeing their portfolio’s in blood bath.

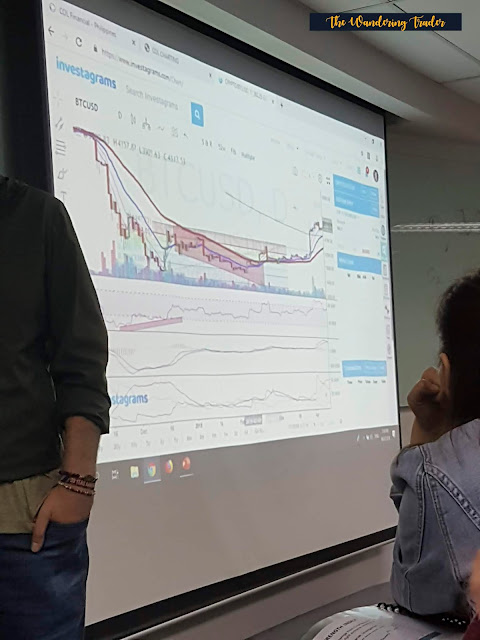

(Source: Investaprime - useful trading tool)

Mid 2019 was the year that I invested my spare time to

attend free and paid stock market and other various business seminars.

To name them, it was Philippine Stock Exchange itself in

Pasig (but the seminar was by the book and it was really boring I even slept

for minutes listening), COL Financial (all of their free basic topics including

basic identifying candlesticks on a visual chart), How To Make Millions in

Stock Market by Truly Rich Club Bo Sanchez which I paid P6,000+ with gold

membership and free accidental insurance worth 100K plus Bo Sanchez'

worth-to-read books (it was attended I think around 300+ guests in SMX

Convention Taguig), TGFI with First Metrosec under Metrobank group which I paid

I think P3,000+ with VIP membership and free Sunlife accidental insurance worth

100K perks.

(The Philippine Stock Exchange in Pasig City)

(TGFI - Passive Income Conference 2019 in Taguig City)

(COL Financial, Inc. free stock market basic introduction seminar in Pasig City)

(COL Financial, Inc. free stock market basic technical analysis seminar in Pasig City)

(How to Make Millions in Stock Market by Truly Rich Club, Bro. Bo Sanchez in SMX Convention Center, Taguig)

(How to Make Millions in Stock Market by Truly Rich Club, Bro. Bo Sanchez in SMX Convention Center, Taguig)

On June 25, 2019, I did the "buy and forget"

mentality since my thought was only to be a “small investor” from local stock market by that time and gave cryptocurrency particularly Bitcoin trading a shot (..and I gained some from Bitcoin and forex particularly EUR/USD without over analyzing the technical chart and stick with market sentiment since the volume is really moving fast. It was very risky.) I only

tried buying in least MBT @73.90 then sold, bought JFC @285.00 also but sold it and

bought ALI @51.80 amounting at less than P4,000.00 from the initial capital and

forget what I just did. I was like a tourist at the time, not really knowing what's going on...

(The platfrom I'm using for global stock and cryptocurrency trading is Etoro.

Global is where you can buy Starbucks, Mcdo, Coca-Cola, Apple, Amazon, Paypal, Netflix, crude oil stocks.)

Global is where you can buy Starbucks, Mcdo, Coca-Cola, Apple, Amazon, Paypal, Netflix, crude oil stocks.)

I have watched all the complete episodes in Money Heist from Netflix, La Luna Sangre from iWant

TV, chatting with my friends about their life and love life (baka may mai-reto pala kayo sa single friends ko.. haha!), playing my dogs, loving my family, eating well, and destress myself away from e-commerce industry and freelancing between end of March to first week of April 2020. What a relief!

An announcement of extended community quarantine made me

think of going back learning stock market and other stuffs I needed in order to improve my self growth by do-it-your-own-research online. Following with some blogs I've been working on and continuously contributing in work from home practical side income website. It was not easy setting this all up and catching up with what I probably be missing. Hence, it made me feel bored to watch Netflix and Youtube every single quarantine day.

I saw the opportunity to make something more important happen that I did not

able to do because of ‘priorities’ (excuses perhaps? or was I really in a productive stage of supplying stocks to customer, managing various e-commerce and social media platforms).

First analysis was really a tough one. I must diagnose what kind of trader I am, the objective of my trading and my budget in buying stocks. Basically, my objective was to invest in long-term as early as possible with my modified strategic averaging method, so atleast I have the source of compounding passive income. Inflation in our economy nowadays is real you know. Not unlike before that elderly people can only save money and leave it to bank because inflation is almost none. Being able to adapt with changes is street wise.

I did all the screening of possible stocks to watch in my list and summarizing their current underlying factors manually, everyday. Until I screened them down to 5 ~ 15 stocks and tried using my another strategy which is analyzing the chart using technical analysis (day and week time frame). Some analyze the chart in 5-min., 30-min., 1-hour, 4-hour so you cannot really follow other traders on how they trade and question what to buy dahil maaaring magkaiba pala kayo ng diskarte.

I've decided to add a conservative fund to my broker’s trading platform which is COL Financial, Inc. on March 25, 2020 and I know that I will only buy stocks in tranche, not all-in. I thought that I will make a reset but I know I have to learn it in extensive way possible and not be trapped in a state of analysis paralysis. And the slight upgrade in funding follows (just to be sure I have enough buying power when I saw opportunity in specific stocks because it comes too fast and volatile). Don't get me wrong, my funding budget didn't go as high as 6-digits. Para lang may allowance sa pagbili ng shares of stock or what PSE calls the Board Lot. My available balance in my broker's online trading platform is also withdrawable anytime, kesa nakatambay lang sa bank ang savings during quarantine. I secured my emergency funds already, it was separated before going in another investing journey.

First analysis was really a tough one. I must diagnose what kind of trader I am, the objective of my trading and my budget in buying stocks. Basically, my objective was to invest in long-term as early as possible with my modified strategic averaging method, so atleast I have the source of compounding passive income. Inflation in our economy nowadays is real you know. Not unlike before that elderly people can only save money and leave it to bank because inflation is almost none. Being able to adapt with changes is street wise.

I did all the screening of possible stocks to watch in my list and summarizing their current underlying factors manually, everyday. Until I screened them down to 5 ~ 15 stocks and tried using my another strategy which is analyzing the chart using technical analysis (day and week time frame). Some analyze the chart in 5-min., 30-min., 1-hour, 4-hour so you cannot really follow other traders on how they trade and question what to buy dahil maaaring magkaiba pala kayo ng diskarte.

(List of picked candidate stocks I put in excel manually, everyday)

(I even print this out just to see it clearly and make adjustments before price action)

I've decided to add a conservative fund to my broker’s trading platform which is COL Financial, Inc. on March 25, 2020 and I know that I will only buy stocks in tranche, not all-in. I thought that I will make a reset but I know I have to learn it in extensive way possible and not be trapped in a state of analysis paralysis. And the slight upgrade in funding follows (just to be sure I have enough buying power when I saw opportunity in specific stocks because it comes too fast and volatile). Don't get me wrong, my funding budget didn't go as high as 6-digits. Para lang may allowance sa pagbili ng shares of stock or what PSE calls the Board Lot. My available balance in my broker's online trading platform is also withdrawable anytime, kesa nakatambay lang sa bank ang savings during quarantine. I secured my emergency funds already, it was separated before going in another investing journey.

Early week of April 2020, when I started to buy my first stock which is ALI (again), not knowing what to watch out for and consider the most during this pandemic crisis. Because that time I just

think that ALI is "Ayala Land" and it has ‘good foundation’ so why not, and the fact that it was really a bargain! I only

stick with my fundamental analysis and not really being attentive to what’s

happening in the market’s behavior especially we’re in a bearish (clear downtrend).

To sum up, here’s the list happened in my portfolio on April

13, 2020:

ALI -1.40%

BDO -4.61%

FLI -4.39%

HOME -0.95%

JFC +9.76%

SECB -6.96%

SMC -3.75%

TECH -13.17%

A total of -1.55% in my portfolio. Why this is all negative?

It’s because of the average price (broker’s commission fees, PSE fees and

taxes). Unang bili mo pa lang talaga, expect your portfolio to be in red. Though

here’s the tip to maximize the ‘charges’ in buying transaction, follow the

P8,000.00 RULE when buying any kind of stock. It will always be good to buy

amounting P500.00~P4,000.00 per stock, but the charges will eat up your

supposed to be possible gains.

(Investing amount differences: if you bought 2.00/per share and sold it at 2.30/per share before any charges)

So the idea of fundamental basis alone should be off the chart during

this crisis, since I naturally observed that most of the traders are taking a

short profit during most of the hours in a day. Not mentioning the big institution, ofw’s and net foreign buyers. Those players have a minimum buying power of P100,000.00 ~ P2,000,000.00 to play by the way so they can take short. Short plays happening at most times and this is not the best time to think for a long-term, since we are still in a bear market, uncertain situation about coronavirus and quarantine.

To sum up, here’s the list happened in my portfolio on April

15, 2020:

ALI +4.80%

BDO +4.80%

FLI +3.15%

HOME +26.58%

JFC +37.17%

SMC +4.28%

A total of +17.77% in my portfolio. That was the time that I

am very happy because it’s my birthday and I considered my new found learning

ground as a priceless gift to self, because I started the stock market journey

without any ‘excuse’ in my head though I firstly thought of the budget from my

savings. I sold SECB when I started to deeply understand the market more than

yesterday, though I wish I didn’t let go of MEG and TECH so early. TECH is the

most traded stocks 2nd from DITO, since I lately found out that they

are in demand in supplying chips for hospital equipment especially for to speed up the COVID-19 recovery.

PSEI being negative at -7.07% with only +8.67% in my

portfolio on April 16, 2020. With -9.1% in total account equity value might not be acceptable from any portfolio’s paper loss.. Ideally it must be 3% to 5% loss and it

must be more in the gaining side. When I saw my portfolio being negative from

ALI -6.99%, BDO -0.62%, FLI -0.08%, I started to rethink and see my possible

mistake has been made, again. I did the extensive analysis from every information,

changes from these companies and I started to re-learn the technical analysis.

On April 30, 2020 was the day that I can say that I know how

to my manage risk-reward, identifying the trend, setting up my plan, price entry/cut

loss execution and most specially discovered my own trading strategy.

March to April 2020 was the highest record of volatility of

all times and I felt that it was really a battlefield from day to day basis.

Waking up at 7:30am, one and a half hour before just to review the market, plan

the trade, recheck projected opening prices at 9:00am and execute the final

price entry in between 9:15am to 9:30am. I spent up my effort to make this

hardship and losses my everyday learning curve, even I'm

not a day trader at this moment. Ending April 2020 up by +20.82% in my portfolio. Happy (almost) one month! I learned alot and continue to learn.

Stock market is highly volatile. This is NOT for everybody.

People thought that “stock trading or investing” was easy

but it’s not. It's simple if you acquire learnings.

It is an extensive form of brain storming, time consuming analytical effort and the MOST

BORING WAY TO LEARN BEFORE YOU CAN POSSIBLY EARN.

It will test your DISCIPLINE in most possible way and you

will acquire discipline that you can use in day-to-day living.

Always find the like-minded people that can help or motivate you in reaching your stock trading journey, but do not follow recommendations blindly. Whatever happens, plan your trade and always trade your plan.

What’s your beginning and failing story? Let your story be heard!

Stock Market References:

How To Start in Stock Market with Zero Knowledge

Top 6 Reasons Why Stock Market is A Must Investment During Lockdown Quarantine ECQ (Covid-19 Coronavirus Pandemic Outbreak)

8 Reasons Why You Should Not Invest in Stock Market

Top 30 PSEI List to Consider Buying

P.S. Thank you for the past 2 weeks. I might NOT be as active as ECQ days, but I hope I contributed some practical insights and reality that might be helpful especially to beginners who are bombarded with recommendations from others. Since I will get back to my ecommerce business, being a freelancer to other side deals and do some backpacking travel goals.

If you want to do collaboration with me regarding with Shopee, Lazada, Carousell, Ebay listings; managing your social media platforms, image editing, product ads editing, transcribing audios, captioning videos, vlogs collab, unbiased stock market questions, list of side income opportunities, don't hesitate to reach me anytime through Facebook page.

Stock Market References:

How To Start in Stock Market with Zero Knowledge

Top 6 Reasons Why Stock Market is A Must Investment During Lockdown Quarantine ECQ (Covid-19 Coronavirus Pandemic Outbreak)

8 Reasons Why You Should Not Invest in Stock Market

Top 30 PSEI List to Consider Buying

P.S. Thank you for the past 2 weeks. I might NOT be as active as ECQ days, but I hope I contributed some practical insights and reality that might be helpful especially to beginners who are bombarded with recommendations from others. Since I will get back to my ecommerce business, being a freelancer to other side deals and do some backpacking travel goals.

If you want to do collaboration with me regarding with Shopee, Lazada, Carousell, Ebay listings; managing your social media platforms, image editing, product ads editing, transcribing audios, captioning videos, vlogs collab, unbiased stock market questions, list of side income opportunities, don't hesitate to reach me anytime through Facebook page.

(One of the direct invites from Upwork)

(One of the direct invites from Linkedin)

Follow us so you don't miss every potential opportunity that might work for you,

Website - https://recalibrated.weebly.com

Facebook Groups - https://www.facebook.com/groups/moneywiserecalibrated

Instagram - https://www.instagram.com/moneywiserecalibrated

Twitter - https://twitter.com/MRecalibrated

Your little support will go a long way!

For more updates in stock market trades, https://www.investagrams.com/Profile/thewanderingtrader

thanks to my stock market philippines broker</a., my journey begins too

ReplyDelete